change in net working capital as a percentage of change in sales

Change in Working capital does mean actual change in value year over year ie. To get a real understanding of the companys operational efficiency we need to look at change in working capital.

If a transaction increases current assets and.

. The formula is working capital divided by gross sales times. Net working capital NWC is current assets minus current liabilities. To calculate net sales subtract returns 400 from gross sales 25400.

Current Operating Assets 50mm AR 25mm Inventory 75mm. What is NWC formula. Companies may over stock or under stock because of expectations of shortage of raw materials.

The working capital to sales ratio uses the working capital and sales figures from the previous years financial statements. Changes in working capital -2223. A change in working capital is the difference in the net working capital amount from one accounting period to the next.

Hence there is obviously an assumption that working capital and sales have been accurately stated. For most companies you analyze by using the change in working capital in this way the FCF calculation and owner earnings calculation is similar as it was for Amazon and Microsoft. And it helps determine this amount based on the total revenue or sales from an operation.

Working capital as percent of gross revenues indicates how much working capital your farm business may need. For accounts payable are 20 million and sales are 100 million accounts payable as a percentage of sales would be 20. Secondly the coming years sales forecast is.

For year 2020 the net working capital is 10000 20000 Less 10000. The NWC relative to sales varies by industry as net working capital can represent 2 of sales or even 20 of sales. The higher a companys working capital as compared to sales the better off and more stable the company is financially.

Changes in working capital are reflected in a firms cash flow statement. NWC is a way of measuring a company. You can express the ratio as a percent that tells you what percentage of net working capital you have out of all incoming cash flow.

Finance questions and answers. Here are some examples of how cash and working capital can be impacted. Setting up a Net Working Capital Schedule.

Therefore working capital will decrease. So a positive change in net working capital is cash outflow. Such a trend line is an excellent feedback mechanism for showing management the results of its decisions related to working capital.

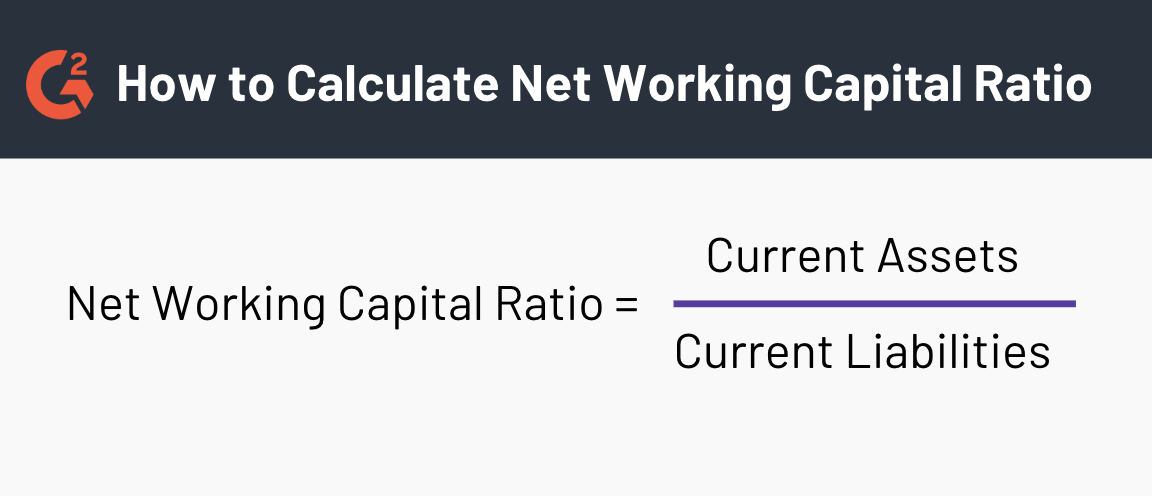

If no other expenses are incurred working capital will increase by 20000. Net working capital is defined as current assets minus current liabilities. The sales to working capital ratio is calculated by dividing annualized net sales by average working capital.

For working capital add the accounts receivable 8333 and inventory 12500 then subtract accounts payable 1042. The net working capital NWC formula is. The FFSC defines.

Working capital as a percent of sales is calculated by dividing working capital by sales. If a company sells merchandise for 50000 that was in inventory at a cost of 30000 the companys current assets will increase by 20000. 19 _____ A NWC changes in direct relation to sales but the change may be less than proportional with sales.

Owner Earnings 8903 14577 5129 13312 2223 13084. So if the change in net working capital is positive it means that the company has purchased more current assets in the current period and that purchase is basically outflow of the cash. The business would have to find a way to fund that increase in its working capital asset perhaps by selling shares increasing profits selling assets or incurring new debt.

If a company borrows 50000 and agrees to repay the loan in 90 days the companys. The change in working capital value gives a real indication on why the. In this case the change is positive or the current working capital is more than the last year.

Changing working capital does mean actual change in value year over year. But it means the change current assets minus the change current liabilities. In general the higher the number the more financial risk is involved in company operations as it takes a higher degree of assets to run short-term operations.

You could allow working capital to decline each year for the next 4 years from 10 to 6 and once this adjustment is made begin estimating the working capital requirement each year as 6 of additional revenues. Calculation of the Sales to Working Capital Ratio. At the very top of the working capital schedule reference sales and cost of goods sold from the income statement Income Statement The Income Statement is one of a companys core financial statements that shows their profit and loss.

If a business requires a lot of current assets to generate sales and those assets are funded by cash then the net working capital as a percentage of sales will likely be high. Net Working Capital Cash and Cash Equivalents Marketable Investments Trade. Working Capital to Sales.

Net working capital is also known simply as working capital. Compare the ratio against other companies in the same industry for additional. For the year 2019 the net working capital was 7000 15000 Less 8000.

Net Working Capital NWC 75mm 60mm 15mm. Net change in Working Capital 1033 850 183 million cash outflow Analysis of the Changes in Net Working Capital. If a business has high operating leverage then there.

The percentage of sales method is the simplest and easiest way of finding future working capital. Its primary benefit is measuring the amount of working capital needed or to specify the size of working capital requirements. For year 2 calculate the change in net working capital as a percentage of year 1.

Now changes in net working capital are 3000 10000 Less 7000. Similarly change in net working capital helps us to understand the cash flow position of the company. Current Operating Liabilities 40mm AP 20mm Accrued Expenses 60mm.

Below are the steps an analyst would take to forecast NWC using a schedule in Excel. Its also important for predicting cash flow and debt requirements. For instance if a companys current liabilities are 1890000 its current assets are 2450000 and its total assets equal 3550000 the company can find its net working ratio like this.

Thus if net working capital at the end of February is 150000 and it is 200000 at the end of March then the change in working capital was an increase of 50000. Although borrowing money to finance new equipment or other initiatives to help increase sales is not bad on its own a company must still be able to easily pay down its. First each component of working capital as a percentage of sales is calculated.

It means the change in current assets minus the change in current liabilities. Given those figures we can calculate the net working capital NWC for Year 0 as 15mm. Its a calculation that measures a businesss short-term liquidity and operational efficiency.

Change in Net Working Capital 12000 7000. The working capital to sales ratio shows a companys ability to pay costs related to generating new sales without the need to take on additional debt. Now lets break it down and identify the values of different variables in the problem.

As for the rest of the forecast well be using the.

The Percentage Of Sales Method Formula Example Video Lesson Transcript Study Com

10 Sample Balance Sheet For Small Business Payment Format Inside Mechanic Job Free Business Card Templates Business Plan Template Business Proposal Template

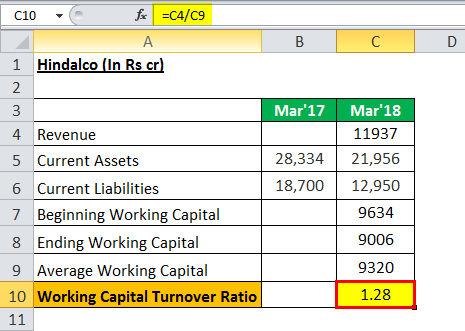

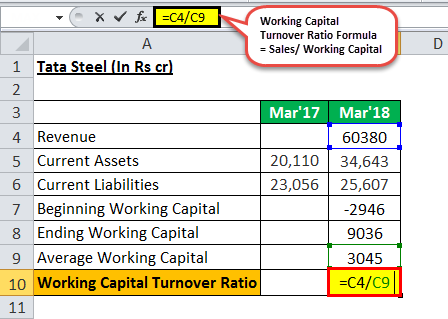

Working Capital Turnover Ratio Meaning Formula Calculation

Change In Net Working Capital Nwc Formula And Calculator

Changes In Net Working Capital All You Need To Know

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Nwc Formula And Calculator

How To Calculate Working Capital Turnover Ratio Flow Capital

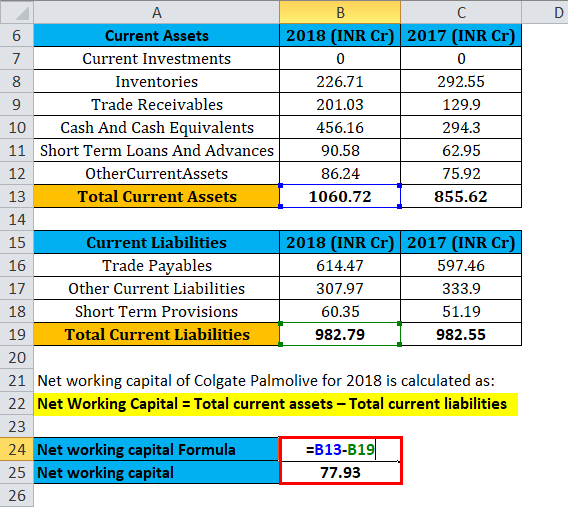

Net Working Capital Formula Calculator Excel Template

Change In Working Capital Video Tutorial W Excel Download

Financial Ratios Calculations Accountingcoach In 2021 Financial Ratio Financial Management Debt To Equity Ratio

What Is Net Working Capital How To Calculate Nwc Formula

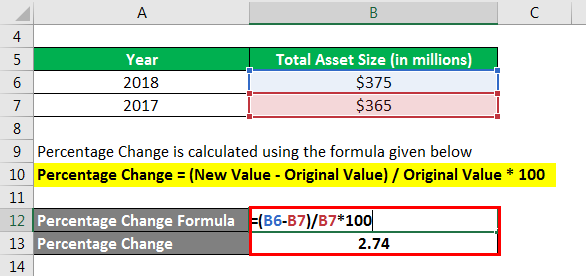

Percentage Change Formula Calculator Example With Excel Template

Interim Financial Statement Template Unique Interim Financial Statements Example Lux Statement Template Mission Statement Template Personal Financial Statement

Change In Working Capital Video Tutorial W Excel Download

Working Capital Turnover Ratio Meaning Formula Calculation

Percentage Change Formula Calculator Example With Excel Template

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)